Our Blog

Browse Our Collection of Weekly Content To Learn More About Retirement Planning, Taxes, and more!

How Can I Recession-Proof My Retirement?

When people think about retirement, they often imagine years of relaxation and freedom. But for many retirees and pre-retirees, that vision comes with an underlying concern: what happens if the market takes a downturn? Recessions are an unavoidable part of the economic cycle, and while you can’t control when or how severe they are, you can take steps to prepare. [...]

Will My Income Keep Pace with Inflation?

Retirement is supposed to be the time when you finally get to enjoy the fruits of your hard work. But one of the most common concerns retirees share is whether their income will be enough—not just today, but 10, 15, or even 20 years from now. Inflation doesn’t just raise prices in the short term; it compounds over time, quietly [...]

Hidden Retirement Costs—What You Don’t Plan for Can Impact Your Finances

What exactly are “hidden costs” in retirement? Hidden costs are the expenses that don’t make it into your retirement spreadsheet—but still show up in real life. They include things like rising healthcare bills, inflation, home repairs, and financial support for family. While not necessarily “surprise” expenses, they’re often underestimated or completely forgotten in retirement planning. How much can hidden costs [...]

Why the Federal Reserve Works, And What It Means for Your Retirement

The Federal Reserve may seem distant or complicated, but its decisions ripple through everything from interest rates to inflation, and that may affect your retirement directly. Let’s explore why the Fed works, why its independence matters, and what that means for your financial stability in retirement. What exactly is the Federal Reserve supposed to do? The Federal Reserve has two [...]

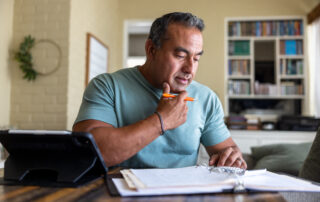

“I Think I Have Enough Saved—Why Am I Still Worried?”

You’ve worked hard and saved diligently, and now you're in retirement or on the doorstep of it. You’ve run the numbers. You might even have a sizable nest egg. So why do you still feel uneasy? That lingering anxiety is more common than you think, even among those who appear to be financially prepared for retirement. And it often comes [...]

Follow the Bond Market to Better Understand Your Finances

On May 16, 2025, Moody's downgraded the U.S. sovereign credit rating from Aaa to Aa1, citing concerns over the nation's rising debt and interest payment burdens. This move follows similar downgrades by S&P in 2011 and Fitch in 2023, marking the first time all three major credit agencies have rated U.S. debt below their top tier. Understanding Bond Ratings Bond [...]

What Retirees Should Know About Their Income Tax

Retirement is a new phase of life, and so is your tax situation. Knowing what counts as income and how it’s taxed can make a big difference in how long your money lasts. Below are some of the most common tax questions retirees ask. Can I Avoid the Income Tax in Retirement? What Would That Take? It’s tough to avoid [...]

“What Can I Do with $100K in Retirement?”

Understanding the Shift from Accumulation to Income As a financial advisor, one of the most common questions I hear, especially from clients entering retirement, is: “What should I actually do with these savings I’ve amassed for retirement?” It’s a great question. And it usually signals something deeper: the start of the distribution phase of retirement. You’ve spent years in the [...]

Our Services

CREATIVE RETIREMENT DESIGNED BY CREATIVE PEOPLE

We bring you a new way to frame your retirement by focusing on the following areas:

Income Planning

Live life on your terms and help protect your portfolio against any market.

Tax Review & Analysis

Give your taxes the attention they deserve.

Retirement Accounts

Active investment management with a customized plan.

Insurance

Protect your hard-earned assets and plan for rising healthcare costs.

Explore different life insurance coverage options HERE.

Succession Planning

Align your estate with your financial goals.