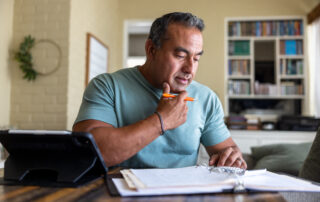

The Role of a High-Yield Savings Account in Retirement

A high-yield savings account has long been a go-to tool for savers looking to earn a little extra interest on cash reserves while keeping funds accessible. But the role it plays can shift dramatically [...]